ENVIRONMENTAL BENEFITS

Recycling instead of burning local waste

Until now, a large part of the wood waste in the Nkok Special Economic Zone had been burned off, since only a fraction of the log discards could be used (e.g. active charcoal, pallets, re-use by local sawmills). The company is the recycling processor of last recourse, thus avoiding that the unwanted waste be burned off or simply dumped in open air sites. Instead of burning the waste in Gabon, we transform it into valuable renewable energy that heats homes and schools in Europe.

Only fully certified wood waste

Since 2018, all the logs that enter the GSEZ are audited by Tracer, an independent French firm. Just like FSC, Tracer uses a due diligence system giving full traceability of each log to its exact origin. Our wood waste comes solely from GSEZ log waste, and is certified as EUTR (EU Timber Regulation).

NO CLEAR-CUTTING

Gabon is quite ecologically minded, with 13 national parks covering 3 million hectares. Unlike Europe or North America, there is NO CLEAR-CUTTING of forests in Gabon. On average, only one or two trees are harvested every year per hectare of forest. The trees are systematically identified and harvested using detailed mapping. Clear-cutting makes no sense since the vast majority of the logs would have no commercial value, making clear-cutting commercially idiotic.

"Transforming waste into a valuable clean and renewable fuel is the most meaningful contribution to sustainable development I can think of. Congo basin pellets has shown an enormous courage and commitment and is paving the way for sustainable energy generation and use in Africa. The fact that there is so much demand for pellets as sustainable fuel now around the world underpins this is the right project at the right point in time."

Christian Rakos

President ProPellets Austria

<span data-metadata=""><span data-buffer="">SOCIAL BENEFITS

<span data-metadata=""><span data-buffer="">Local employment, single mothers, skilled labor

Employing single mothers

In 2023, we expect to employ about 70 Gabonese on staff, of which about 55 single mothers from the local town of Essassa. On average each single mother provides for a family of 4 to 5 children, and often parents or in-laws

Developing skilled workers

To build our machines locally, we have developed a network of electricians, welders, mechanics and other engineers to help us manufacture grinders, briquette presses, conveyor belts, drum dryers and other equipment.

<span data-metadata=""><span data-buffer="">Accelerating import substitution

We are not happy with importing machines when we can have them just as well made locally in Gabon for a fraction of the cost. Knowing how our machines are built also means that local technicians can maintain and repair them.

Financial BENEFITS

Four good financial reasons to invest

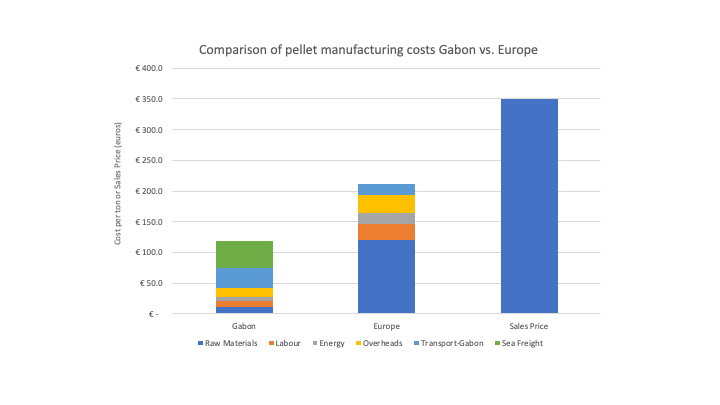

Operating margins

The possibility of exporting by container implies that the company will generate its first sales in 2022, and will then rely on 40-foot container loads for its ongoing revenue streams. Over the next five years, it is expected that the company will export up to 65 containers per month, consisting of 2/3 pellets and 1/3 briquettes. Each container of pellets brings in € 8,500 in revenues and about € 3,600 in margin. A container of briquettes brings in € 7,000 in revenues for about € 2,500 in gross margin.

All our production is pre-sold

The war in Ukraine with its twin consequences – embargo on Russian and Belarusian pellets and fossil fuels – has increased demand and prices. Bagged pellets saw spot market price explosions, up to 10 euros per 15-kilo bag.

We currently have three wholesalers (United Kingdom, France and Italy) waiting for us to confirm how much we could deliver before the end of the year.

Growth of demand

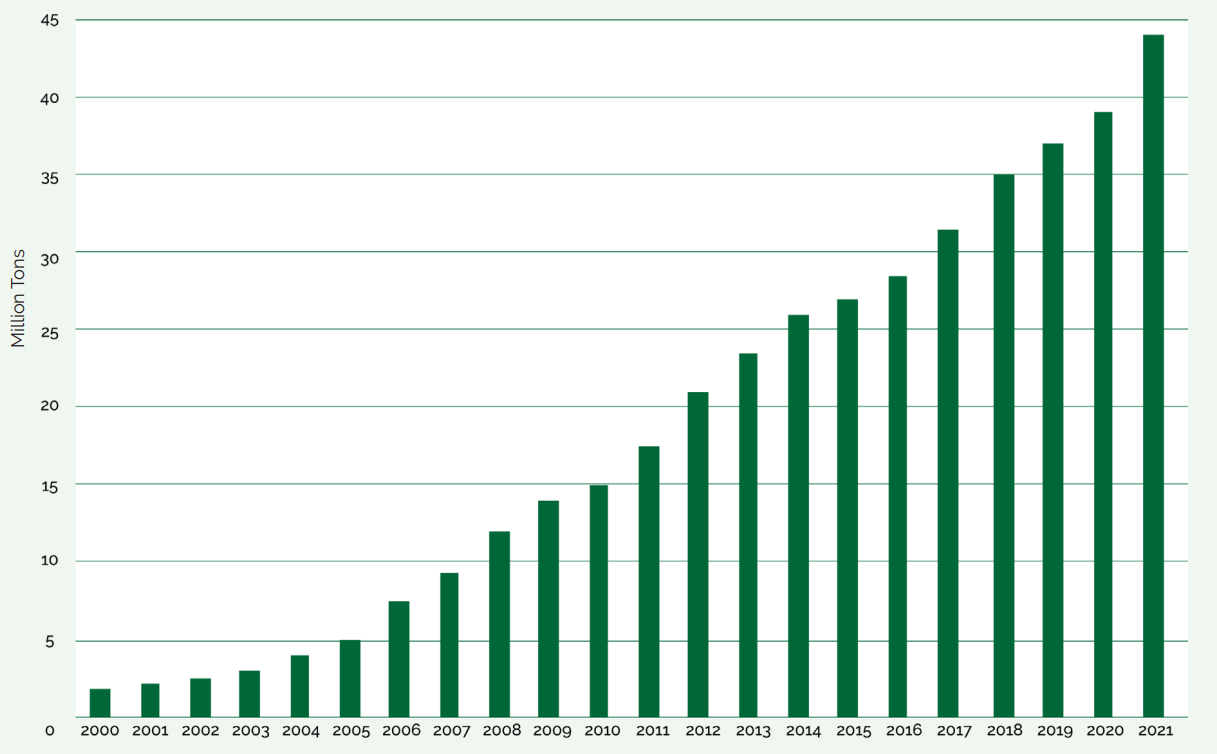

Over the period from 2000 to 2021, worldwide pellet production has grown from about 2 million tons to about 44 million tons, representing a compound annual growth rate of a staggering 18%. Growth in demand will be stimulated by the replacement of old fuel oil or natural gas boilers, given stricter government regulations; by the practicality of pellet stoves in less-heat-intensive areas such as southern Europe; and by the relative cheapness of pellets compared to oil heating systems.

As pressure from climate change threats and activists increases, the outlook for wood pellets, a renewable energy source, is bright. Most of the market experts predict that high-quality pellet sales will continue to increase by 5% to 10% per year for the foreseeable future, given that pellets are renewable, stable in price, offer easy on-off functionality, and are user-friendly.

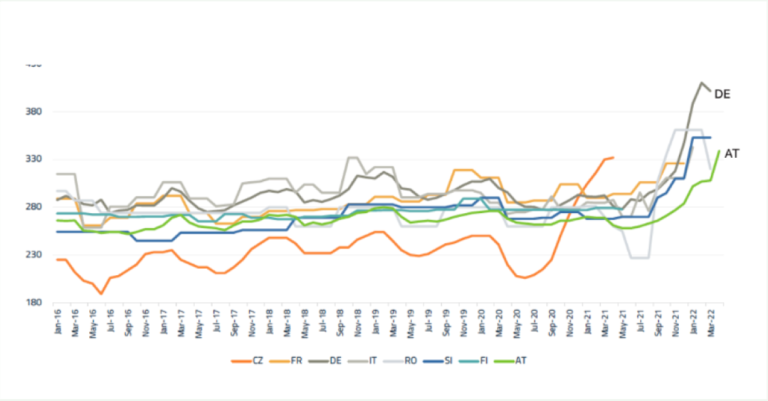

Price explosion

Bagged pellets in the top European markets saw a drastic price increase in the winter of ’21/’22, with a 35% jump in prices. Germany and Switzerland lead in pellet prices, at about 400 euros/ton when the bagged pellets are purchased by the pallet-load. Austria, Italy and France follow at about 350 euros/ton.

The increase in these prices is both due to the strong underlying demand for wood pellets as a renewable energy that qualifies for carbon credits, and the recent embargo on Russian and Belarusian pellet exports, which eliminated about 3.5 million tons of supply in the market.

Sustainable investing

Help us with our second funding round

With the help of your funds, for 2023, we intend to explore the following business expansion projects:

Setting up briquette production in our current factory, as well as in two other sites in Gabon

Commission locally made machines as backups so as not to interrupt our production flow

Supplying biomass to 2 or 3 thermal power plants in the Gabon hinterland (ca. 50,000 tons)